Although Bitcoin (BTC) continues to hold steady in the mid-$80,000 range, analysts are forecasting that significant volatility may be imminent for the leading cryptocurrency. That said, most analysts predict a potential price rally for the apex digital asset.

Bitcoin Ready To Experience Significant Volatility

In a CryptoQuant Quicktake post, contributor Mignolet highlighted that approximately 170,000 BTC has recently moved from the 3–6 month holder cohort. Historically, such large movements from this group have often preceded notable price swings.

Mignolet shared the following chart, noting how spikes in BTC movement from the 3–6 month cohort have frequently led to heightened price volatility. Notably, green boxes denote upward price movement, while red boxes indicate price declines.

Several crypto analysts have shared their insights on recent BTC price action based on both on-chain metrics and technical chart patterns. For example, seasoned crypto analyst Master of Crypto made an observation about the realized price of short-term holders (STH) versus long-term holders (LTH).

According to the analyst, STH are currently mostly in the red, with a realized price of around $92,700, while LTH have a realized price of $26,500, meaning they’re sitting on gains of over 200%.

Master of Crypto added that whenever such a wide gap exists between STH and LTH realized prices, it often paves the way for severe price volatility. They concluded by saying “either the weak hands fold, or we rip higher.”

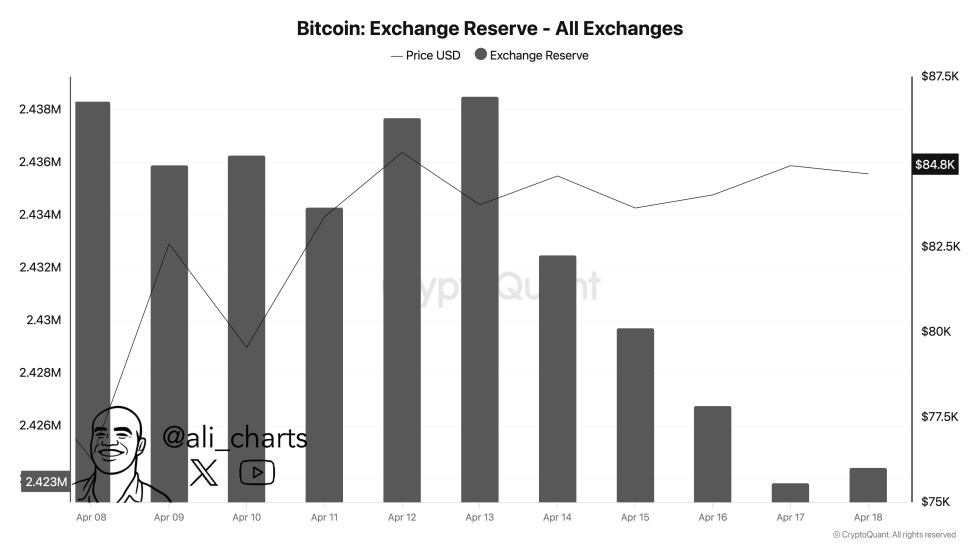

Seasoned crypto analyst Ali Martinez provided an optimistic take on potential BTC price action based on on-chain analytics. The analyst noted that more than 15,000 BTC have been withdrawn from crypto exchanges over the past week.

Low exchange reserves are typically bullish for BTC, as they suggest investors prefer to hold rather than sell at current prices. Additionally, reduced exchange balances reinforce the supply scarcity narrative for the asset.

Analysts Forecast BTC Reversal In Near-Term

Another analyst, Ted, drew attention to BTC’s correlation with the global M2 money supply. According to Ted, Bitcoin is tracking the growth in global M2 with a 108-day lag, suggesting a potential trend reversal as early as May. The analyst further added:

I think for the next few weeks, BTC could consolidate between $75K-$90K. During this timeframe, retail will most likely panic sell while smart money will accumulate.

Meanwhile, noted analyst Titan of Crypto recently stated that BTC’s consolidation around the $83,000 level could be laying the groundwork for a rally toward $135,000. At press time, BTC trades at $84,553, up 0.5% in the past 24 hours.

Featured Image from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.